The Bureau of the Treasury raises P420.4 billion from sale of RTBs

The Bureau of the Treasury raises P420.4 billion from sale of RTBs

The Bureau of the Treasury (BTr) successfully raised P420.448 billion worth of 5.5-year Retail Treasury Bonds (RTBs) with a coupon rate of 5.75%. P162.721 was awarded at the rate-setting auction, while a total of P149.210 billion and P108.517 billion were raised in new money and through the bond exchange, respectively, during the two-week offer period.

The 28th tranche of the RTB is the 4th largest RTB issuance to date, while the amount raised through the Switch Program is the largest since the bond exchange was introduced in February 2020.

First Metro Investment and First Metro Securities continued to support the BTr in this endeavor. As one of the joint issue managers for the offering, First Metro Investment was heavily involved in executing and selling the issuance, as well as in promoting RTB-28 through online and hybrid briefings for investors across the country. First Metro Securities likewise actively promoted the RTBs in its social media platforms and facilitated various online events for both local and international investors. In addition, the FirstMetroSec app served as one of the online ordering facilities of the BTr.

Proceeds from the issuance are intended to support the country’s various programs for economic resiliency and a strong post-pandemic recovery.

The Bureau of the Treasury (BTr) successfully raised P420.448 billion worth of 5.5-year Retail Treasury Bonds (RTBs) with a coupon rate of 5.75%. P162.721 was awarded at the rate-setting auction, while a total of P149.210 billion and P108.517 billion were raised in new money and through the bond exchange, respectively, during the two-week offer period.

The 28th tranche of the RTB is the 4th largest RTB issuance to date, while the amount raised through the Switch Program is the largest since the bond exchange was introduced in February 2020.

First Metro Investment and First Metro Securities continued to support the BTr in this endeavor. As one of the joint issue managers for the offering, First Metro Investment was heavily involved in executing and selling the issuance, as well as in promoting RTB-28 through online and hybrid briefings for investors across the country. First Metro Securities likewise actively promoted the RTBs in its social media platforms and facilitated various online events for both local and international investors. In addition, the FirstMetroSec app served as one of the online ordering facilities of the BTr.

Proceeds from the issuance are intended to support the country’s various programs for economic resiliency and a strong post-pandemic recovery.

First Metro appoints new vice chairman and independent director

First Metro appoints new vice chairman and independent director

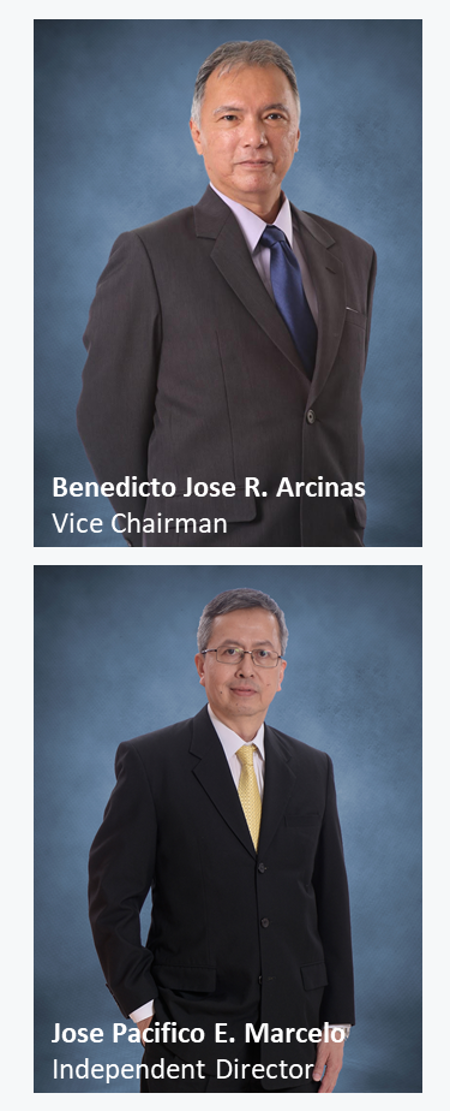

First Metro appointed Benedicto Jose Arcinas as its new vice chairman and Jose Pacifico Marcelo as its new independent director during the company’s board meeting held on September 26, 2022.

Prior to his appointment as vice chairman of the board of directors, Mr. Arcinas was an independent director of First Metro from May 2021 to September 2022. He succeeded Mary Mylene Caparas, who is now the board chairperson. Mr. Marcelo, on the other hand, replaced Atty. Raphael Perpetuo Lotilla, who has been appointed as Secretary of Energy.

First Metro appointed Benedicto Jose Arcinas as its new vice chairman and Jose Pacifico Marcelo as its new independent director during the company’s board meeting held on September 26, 2022.

Prior to his appointment as vice chairman of the board of directors, Mr. Arcinas was an independent director of First Metro from May 2021 to September 2022. He succeeded Mary Mylene Caparas, who is now the board chairperson. Mr. Marcelo, on the other hand, replaced Atty. Raphael Perpetuo Lotilla, who has been appointed as Secretary of Energy.

Mr. Arcinas is a seasoned professional with over 30 years of experience in the finance and banking industry. He is currently the president and managing director of Arcinas Freres, Inc. and an independent director of Philippine Savings Bank since April 2012.

Mr. Arcinas is a graduate of Bachelor of Science in Business Economics from the University of the Philippines and obtained a Master of Science in Management from the Arthur D. Little Management Education Institute in Cambridge, Massachusetts.

A highly experienced investment banker, Mr. Marcelo is not new to First Metro as he was formerly head of the Investment Banking Group for 15 years.

He has a Bachelor’s degree in Business Economics from the University of the Philippines and an MBA from the Asian Institute of Management.

Mr. Arcinas is a seasoned professional with over 30 years of experience in the finance and banking industry. He is currently the president and managing director of Arcinas Freres, Inc. and an independent director of Philippine Savings Bank since April 2012.

Mr. Arcinas is a graduate of Bachelor of Science in Business Economics from the University of the Philippines and obtained a Master of Science in Management from the Arthur D. Little Management Education Institute in Cambridge, Massachusetts.

A highly experienced investment banker, Mr. Marcelo is not new to First Metro as he was formerly head of the Investment Banking Group for 15 years.

He has a Bachelor’s degree in Business Economics from the University of the Philippines and an MBA from the Asian Institute of Management.

DEALS FOR THE QUARTER

DEALS FOR THE QUARTER

IN THE PIPELINE / NOW OFFERING

IN THE PIPELINE / NOW OFFERING

AROUND THE METRO

AROUND THE METRO

First Metro welcomes a new vice president

First Metro welcomes a new vice president

First Metro recently welcomed Michael Don Capistrano, vice president and head of Client Coverage I Division under the Investment Banking Group. He will be helping the Group in managing deals, developing new partnerships in untapped markets, and building client relationships as First Metro continues to grow its investment banking business.

First Metro recently welcomed Michael Don Capistrano, vice president and head of Client Coverage I Division under the Investment Banking Group. He will be helping the Group in managing deals, developing new partnerships in untapped markets, and building client relationships as First Metro continues to grow its investment banking business.

Don brings with him over 27 years of banking experience in the areas of relationship management, client coverage, product management & development, transaction banking, and credit & risk analysis. Prior to joining First Metro, he was the head of Commercial Banking of Bank of China (HK ltd) – Manila Branch.

He started his banking career with United Coconut Planters Bank under the Corporate Banking Division. He then worked at Citibank N.A.'s Global Transaction Banking as a product manager as well as trade and cash management sales specialist. He also worked at HSBC as a senior relationship manager, head of Relationship Management Support, and as a risk officer under Credit Approvals.

Don is a graduate of San Beda College with a degree in AB Economics.

Don brings with him over 27 years of banking experience in the areas of relationship management, client coverage, product management & development, transaction banking, and credit & risk analysis. Prior to joining First Metro, he was the head of Commercial Banking of Bank of China (HK ltd) – Manila Branch.

He started his banking career with United Coconut Planters Bank under the Corporate Banking Division. He then worked at Citibank N.A.'s Global Transaction Banking as a product manager as well as trade and cash management sales specialist. He also worked at HSBC as a senior relationship manager, head of Relationship Management Support, and as a risk officer under Credit Approvals.

Don is a graduate of San Beda College with a degree in AB Economics.

MyFirstMetroSec: more than just stock trading

MyFirstMetroSec: more than just stock trading

First Metro Securities Brokerage Corporation, the stock brokerage arm of First Metro, recently launched MyFirstMetroSec, the latest interface f their trading platform. From FirstMetroSec NEW, the rebranded MyFirstMetroSec carries the tagline - “more than just stock trading”- given its wider scope and features. This latest platform, available through my.firstmetrosec.com.ph, provides other investment instruments and services, allowing clients access to Conditional Orders, Enhanced Data Analytics and a Consolidated Portfolio.

First Metro Securities Brokerage Corporation, the stock brokerage arm of First Metro, recently launched MyFirstMetroSec, the latest interface of their trading platform. From FirstMetroSec NEW, the rebranded MyFirstMetroSec carries the tagline - “more than just stock trading”- given its wider scope and features. This latest platform, available through my.firstmetrosec.com.ph, provides other investment instruments and services, allowing clients access to Conditional Orders, Enhanced Data Analytics and a Consolidated Portfolio.

Applied Strategic Planning & Forecasting; Financial Planning and Forecasting for COOPs

To help organizations as they revisit their 2022 finances to prepare their 2023 plans, FAMI’s Edwin Valeroso, FVP & head of Special Markets and Training, conducted a webinar for the board members and finance officers of various cooperatives in the country. His talk covered the foundations of strategic planning and financial forecasting.

Back-to-School Preparation and Tuition Planning

Blended learning is out, HyFlex is in! Since many schools begin reverting to onsite classes combined with online learning, parents are once again faced with tuition fee increases. In this Back to School webinar, Rienzie Biolena, FAMI's senior relationship manager, guided parents on how they can integrate paying tuition fees within the year and planning to pay tuition fees in short term and long term through a simulation of college tuition planning.

Personal Finance 101 for Teachers of PEAC Schools

FAMI, in partnership with the Private Education Assistance Committee, celebrated National Teachers' Month by giving teachers a webinar on managing their finances. Relationship manager Belle Pajarillo discussed budgeting, debt management, bonus allocation and investment planning.

DTI Employee Financial Wellness Week

FAMI partnered with the Philippine Stock Exchange and DTI Academy to provide basic personal finance training and introduction to mutual fund investing for employees of the Department of Trade & Industry. Ruth Chaneco, FAMI’s training manager, was one of the speakers and she discussed budgeting, paying debts, emergency funds, investment planning and peso cost-averaging.

Applied Strategic Planning & Forecasting; Financial Planning and Forecasting for COOPs

To help organizations as they revisit their 2022 finances to prepare their 2023 plans, FAMI’s Edwin Valeroso, FVP & head of Special Markets and Training, conducted a webinar for the board members and finance officers of various cooperatives in the country. His talk covered the foundations of strategic planning and financial forecasting.

Back-to-School Preparation and Tuition Planning

Blended learning is out, HyFlex is in! Since many schools begin reverting to onsite classes combined with online learning, parents are once again faced with tuition fee increases. In this Back to School webinar, Rienzie Biolena, FAMI's senior relationship manager, guided parents on how they can integrate paying tuition fees within the year and planning to pay tuition fees in short term and long term through a simulation of college tuition planning.

Personal Finance 101 for Teachers of PEAC Schools

Blended learning is out, HyFlex is in! Since many schools begin reverting to onsite classes combined with online learning, parents are once again faced with tuition fee increases. In this Back to School webinar, Rienzie Biolena, FAMI's senior relationship manager, guided parents on how they can integrate paying tuition fees within the year and planning to pay tuition fees in short term and long term through a simulation of college tuition planning.

DTI Employee Financial Wellness Week

FAMI partnered with the Philippine Stock Exchange and DTI Academy to provide basic personal finance training and introduction to mutual fund investing for employees of the Department of Trade & Industry. Ruth Chaneco, FAMI’s training manager, was one of the speakers and she discussed budgeting, paying debts, emergency funds, investment planning and peso cost-averaging.

Reach First 2022

This year’s Reach First program of FirstMetroSec was conducted at Pasong Kawayan II Elementary School in General Trias, Cavite.

The whole-day outreach activity was intended to help the school prepare for face-to-face classes, after two years of online classes due to the pandemic.

FirstMetroSec donated books, collected through the company's book drive; bookshelves; and industrial fans courtesy of GT Capital. FirstMetroSec employee volunteers spruced up the school by painting the classrooms as well as the chairs, tables and bookshelves of the students. They also planted food plants in the school’s garden.

The outreach program concluded with a financial and investment literacy seminar for teachers, parents and guardians hosted by the Business Development and Marketing Education Departments.

Reach First 2022

This year’s Reach First program of FirstMetroSec was conducted at Pasong Kawayan II Elementary School in General Trias, Cavite.

The whole-day outreach activity was intended to help the school prepare for face-to-face classes, after two years of online classes due to the pandemic.

FirstMetroSec donated books, collected through the company's book drive; bookshelves; and industrial fans courtesy of GT Capital. FirstMetroSec employee volunteers spruced up the school by painting the classrooms as well as the chairs, tables and bookshelves of the students. They also planted food plants in the school’s garden.

The outreach program concluded with a financial and investment literacy seminar for teachers, parents and guardians hosted by the Business Development and Marketing Education Departments.

CAPITAL NOTES is the official newsletter of First Metro Investment Corporation published quarterly.

| |

|

45th Floor, GT Tower International, Ayala Ave. cor. H.V. dela Costa St., Makati City

Tel: (02) 8858 7900 | Fax: (02) 8840 3706

Email: corpcom@firstmetro.com.ph

We want to hear from you. Please let us know your comments or concerns.

Tel: (02) 8511 0795 | Mobile: (0998) 846 8599

Email: customercare@firstmetro.com.ph

You may also contact BSP Financial Consumer Protection Department.

Tel: (02) 8708 7087

Email: consumeraffairs@bsp.gov.ph

CAPITAL NOTES is the official newsletter of First Metro Investment Corporation published quarterly.

| |

|

45th Floor, GT Tower International, Ayala Ave. cor. H.V. dela Costa St., Makati City

Tel: (02) 8858 7900 | Fax: (02) 8840 3706

Email: corpcom@firstmetro.com.ph

We want to hear from you. Please let us know your comments or concerns.

Tel: (02) 8511 0795 | Mobile: (0998) 846 8599

Email: customercare@firstmetro.com.ph

You may also contact BSP Financial Consumer Protection Department.

Tel: (02) 8708 7087

Email: consumeraffairs@bsp.gov.ph